For years, hotel investment decisions have been guided by a simple rule of thumb: bigger markets are generally safer markets. Gateway cities such as New York, Los Angeles, and Chicago have long been seen as the surest bets for development due to their diverse customer mix and destination attractions. Smaller cities, on the other hand, were often dismissed as too volatile or too limited in demand to attract serious capital.

In recent years, however, secondary and tertiary cities have attracted the attention of developers, making those markets ripe for opportunity. Lodging Econometrics reports 6,280 U.S. hotel projects in the pipeline at the end of Q2 2025, with early-planning counts rising year over year and a meaningful share of activity coming from conversions and renovations. That mix is important in smaller markets where right-sizing product can move faster than ground-up builds.

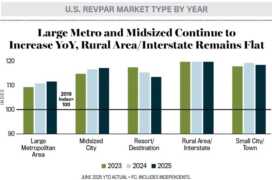

The latest data from Kalibri supports that activity: with performance records from more than 35,000 hotels nationwide, Kalibri’s July 2025 data shows properties in midsized cities and smaller markets are delivering revenue and profitability growth that often outpaces their larger counterparts. In some cases, they are providing healthier returns because they balance steady demand with lower customer acquisition costs.

Abilene: Surprising Strength in West Texas

Few would have predicted that Abilene would rank among the country’s fastest-growing hotel markets. In July 2025, Abilene’s Guest-Paid RevPAR leaped from $59.73 to $101.41, a 70 percent increase compared to the same month in 2024. That kind of growth rivals headline performance in much larger cities.

Abilene’s demand profile illustrates why smaller markets can thrive. Regional corporate travel, government-related business, and project-based stays provided a base that absorbed new capacity while allowing rate growth. At the same time, markets like Abilene often rely more heavily on direct bookings and repeat guests, which means more revenue is retained. The result is not just higher revenue, but stronger profit conversion.

Madison: The Power of Balance

Where Abilene demonstrates sharp growth, Madison, Wisconsin, highlights the value of balance. A state capital and university hub, Madison benefits from government, education, healthcare, and commercial demand. In July 2025, the city’s Guest-Paid RevPAR rose from $90.03 to $102.10, a 13 percent increase year over year.

Madison’s performance underscores the stability that comes from diversified demand. While top-tier cities often struggle with volatile international travel or heavy new supply, Madison shows how midsized markets can deliver consistent, sustainable results. For investors, that kind of resilience is as valuable as rapid growth.

Beyond the Case Studies: A Broader Trend

Abilene and Madison are not isolated. Across the Midwest, Plains, and smaller Western markets, Kalibri data shows similar patterns. Cities like Fort Wayne, Indiana, or San Angelo, Texas, are seeing RevPAR growth that outpaces much larger metro areas.

Lodging Econometrics data confirms the value of smaller market development. The pipeline includes a meaningful share of early-planning projects, suggesting developers recognize the opportunity in midsized cities.

The larger story is that many Tier 2 and Tier 3 markets now show a healthier balance between demand and supply, between occupancy and rate, and between revenue and profitability. For owners and investors, that balance is critical. It signals not only near-term performance but also the ability to withstand economic shifts with less volatility.

Why Profitability May Matter More Than Revenue Growth

Looking only at RevPAR can mask the full picture. Kalibri’s profitability-focused metric, COPE RevPAR (Contribution to Operating Profit and Expenses per Available Room) reveals how much revenue actually drops to the bottom line after acquisition costs. Smaller markets, with stronger direct booking penetration and less reliance on expensive online channels, often retain more revenue per dollar earned.

For investors, this distinction is crucial. Two hotels might post the same RevPAR, but the one with lower acquisition costs delivers higher net operating income and improved long-term asset value. That advantage frequently lies in places historically overlooked by the industry.

Redefining ‘Safe’

The data calls for a reframing of what safety means in hotel development. It is not just about market size or volume of demand. It is about profitability, stability, and resilience. By those measures, many midsized cities are proving themselves not only viable but, in cases like Abilene and Madison, perhaps superior to larger metropolitan areas.

For owners, brands, and investors, the lesson is clear. Secondary and tertiary markets deserve a place at the center of growth strategies. They show that the next cycle of hotel investment success may not be defined by the largest cities, but by the smartest choices in places that combine growth with efficiency.

Appeared first on: lodgingmagazine.com